Tier One Interview: Bill MacDonald

- Jay Judas

- Apr 9, 2021

- 9 min read

This month, Jay sits down with one of the industry’s most successful life insurance producers specializing in executive benefits, Bill MacDonald, Managing Director, EBS – Executive Benefit Solutions and Chairman, My Financial Coach. The two discuss Bill’s lifelong entrepreneurial spirit, how he overcame challenges on his rise to the top and his recent efforts to expand financial planning as an executive benefit through his latest venture, My Financial Coach.

JAY: This interview is a big deal for me, Bill. You are the quintessential successful life insurance producer and at the top of your field in the area of using life insurance to provide and administer executive benefits. In fact, you just celebrated 38 consecutive years as a ‘Top of the Table’ designate with MDRT.

You’ve seen our industry grow and change in different ways and you’ve witnessed the market for executive benefit planning go through ebbs and flows as companies have increasingly embraced them.

Not only are you fully engaged in working with both public and closely held companies in designing, implementing and monitoring compensation plans, you have a side-hustle as the Chairman of My Financial Coach where you are facilitating much needed advice to various professionals. I’ll get back to My Financial Coach later but, first, tell me about Executive Benefit Solutions, or EBS as it is known, and your role with the organization.

BILL: Thanks so much for asking me to do this Jay. I’m honored to have a chance to share my story. As you stated, I’ve been in the industry for many years. I founded Compensation Resource Group, or CRG, many years ago, and with the help of others, built the market leader in executive benefits. I sold that company to a company listed on the New York Stock Exchange and continued to grow it.

One of the firms we acquired was run by Chris Rich and Chris Wyrtzen in Boston. After their earn-out we worked together at another company I founded, RCG. Later, when I sold RCG, Chris and Chris went back on their own and reached out to me to see if I had interest in building another company. I did and joined them at Executive Benefit Solutions.

At EBS we focus on a broader market that also includes private companies and non-profits. We are taking Fortune 500 benefit ideas to mid-market companies.

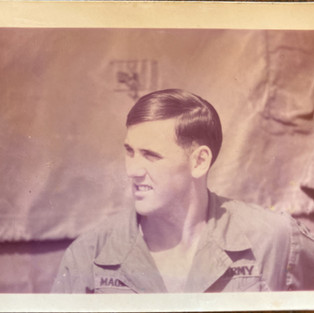

JAY: In a podcast you did last year with Penn Mutual, I heard you talk about how you started out in the agency system and, like many, chased down mortgage leads and the like to make a sale. Take me back even further and tell me where you grew up and wind me through your career path. I know you served in the Army in Vietnam during the war, so I want to acknowledge this sacrifice and thank you for that.

BILL: I grew up in Massachusetts and was the youngest of six. My father died when I was 13 months old, so my mother moved us all to Rhode Island where I grew up through junior high school. I played all kinds of competitive sports, hockey, baseball and others and, like most young men, wanted to play major league baseball. After a few years, we moved back to Massachusetts for my high school.

As a kid I was always entrepreneurial. At 12, I had three paper routes but never delivered a paper. At 17, I started a semi pro basketball team, the Imperial Counts, and hired coaches and players to play against high school faculties to raise money.

After high school, at 18, I joined the Army and went to Vietnam. That was a life experience and I returned one year later, feeling like I was years older. My now wife, Eileen, and I met in high school, but we never dated then. She and I were married in my last five months in the Army and then I applied, and received, an early out to go to college.

As I said, I have always been entrepreneurial, so while going to college full-time I owned a Goodyear franchise with 15 employees. I did that for two years and found it was too much to do while going to school. I then applied and worked under the work study program at Northeastern University, working for an executive recruiting firm, and after placing many people in the life insurance industry, I decided to give it a try myself. Starting out in the family market, moving into the small business market and then qualified plans.

After shoveling snow in New England for way too many years, I decided to move my family to Southern California. I had no prospects or clients there, but felt I had the ability to open doors and sell business. In my first full year there, I qualified for Top of the Table, focusing on closely held companies.

After attending a MDRT meeting in 1982, I heard Glenn Geiger speak on split dollar in the public market and decided that was my direction. I went to the bank, borrowed $3,000, bought a Wang computer and hired a couple of people. I took Glenn’s split dollar design and programmed illustrations and went to the market. Quickly, I found out that you couldn’t lead with product, you needed to lead people to your product.

In studying the competition and what the big consulting firms were doing, I designed a sales process, that I later published in my book MERGE and MERGE 2.0. That was the start of building a really big firm. I hired people smarter than me, and we continue to strive to improve every day.

Years later, with multiple offices and a large percentage of Fortune 1000 companies, I sold to Clark, another company listed on the New York Stock Exchange.

JAY: YPO, the Young Presidents Club, had a profound impact on your trajectory and taught you how to look at your business in a different way than most producers go. You became a member at the relatively young age of 32. What did this association teach you and how did you apply it to your executive benefits practice?

BILL: Yes, YPO was, and continues to be a big part of my success. It gave me a different perspective on business. Most life insurance people think about commissions, while business owners think about margins and profits. During my YPO experience, I attended and graduated from the Harvard Business School’s OPM, the Offices, Presidents and Managers program. I then joined a YPO group at Harvard and have been attending each year for the last 28 years. Doing case studies and interacting with other CEOs, and the top faculty, in different businesses helped me see my company differently. It allowed me to leverage myself and grow a company, rather than be a life insurance commission producer.

JAY: I want to stick with your uncanny ability to ‘zig’ when others are ‘zagging’. Five or six years ago, I saw you speak from the main stage at a life insurance conference. You were telling the audience of producers how you had incorporated social media into your work and urged them to all get on-board. I think we’ve seen some improvement on this in our community but we’re still lagging behind a lot of industries. How do you use social media to help your business and how should a producer who hasn’t, start?

BILL: In my whole career, I have always tried to see through the eyes of my prospects and clients. Early on, through my YPO Harvard experience, I started to see how people were reaching their target audiences through content marketing and social media. As a buyer of any product or service, what do we do today to get information? We Google it! If you’re an expert in your field and someone Googled you, and can’t find you, how much of an expert could you be?

I started by building a presence on LinkedIn, joined communities and gave input, posted interesting topics and made it part of my content marketing strategy. I use Twitter, Facebook and other communities, but Linked In seems to fit my market.

There is no better way to stay connected and reach your target market than with LinkedIn and I know you and Pete and your company are very active there, too.

JAY: We had dinner in Dallas prior to the pandemic and I peppered you with questions about your My Financial Coach venture. At its core, it is a benefit for all sorts of companies and offers a service where there is a huge hole to fill. What is My Financial Coach and how did you come up with the idea?

BILL: After years in the executive compensation and benefits industry, I became alarmed by how many executives received poor advice from financial planners and advisors. They did not understand the benefits offered by their clients’ employers nor leverage them in financial planning. There was a better way to offer unbiased and un-conflicted financial guidance designed to build wealth for executives, not their financial advisors. With a group of like-minded entrepreneurs, I decided to create My Financial Coach.

At My Financial Coach we use technology with salaried Certified Financial Planners, CFP®s, to provide unbiased and un-conflicted financial planning. When I say un-conflicted, I mean we don’t sell any products.

When our CFP®s find gaps, and if the client doesn’t have a current advisor, we refer them to subject matter experts, which we call SMEs. We have vetted out a number of firms with expertise in life insurance, investments, estate planning, retirement planning, taxes, legal and other areas. For our SMEs, this is a great way to leverage your business and meet qualified prospects under favorable conditions.

JAY: Let me steer you back to executive benefits for a moment. We are on the cusp of some huge tax increases at the national level and at many state and municipal levels. What does this mean for the life insurance industry and its tie to executive benefits? Is this good or bad for our industry and are there ways executive benefits can mitigate some of the proposed tax policies?

BILL: These developments are a good thing for our industry, and I will tell you why. As my friend and fellow investor in My Financial Coach, Dr. Arthur Laffer says, “If you raise tax rates, the rich will report less taxable income.” People will be looking for ways to shelter more income. Also, with the changes in Section 7702, accumulation products look so much better today. I think this will have a major impact on smaller and mid-market companies where all the new activity is.

The Fortune 1000, where I spent most of my career, is saturated and controlled by those who administer plans. Many have made a career on replacing what they sold every five to seven years. The real opportunity for most producers is to take Fortune 500 company concepts down market. These may be Section 162 bonus plans, or split dollar. Split dollar is a great private company benefit, especially when designed properly.

JAY: Early in your marriage, you and your wife decided you should live in warm places and I know you split your time between Southern California, Sedona, AZ and the coast of Maine. You also have six grandchildren divided between California and Texas, so I suspect I know how you spend a lot of your free time. What activities and pursuits are you engaged in outside of work?

BILL: I am an avid reader of business and strategy books. I read 10 to 12 new books a year and try and stay on top of all the trends. It surprises me when I talk to salespeople or fellow business owners and find they haven’t read a single sales or strategy book. I also love to golf and play in most club tournaments and similar events. Since we have moved to Sedona, Eileen and I are enjoying hiking the trails.

JAY: Based upon the introduction I gave, it won’t surprise you to learn that I have about a dozen more questions to ask, Bill, but I’ll do that when we next meet for drinks. We’ve come to my restaurant question where I’d like to hear about your favorite spots to eat and the dishes I should order when I visit. As always, do your best not to name a steakhouse or a steak!

BILL: Since I live in different parts of the country, I have a few:

San Diego: Pamplemousse Grille in Solana Beach Ca.

They have an excellent wine list, and my favorite dish is the Crispy Half Duck that is served with sweet white corn, porcini mushrooms, sautéed gnocchi cherry balsamic reduction.

Palm Desert Ca: Mitch’s El Paseo

I know you’ve been here, Jay, and you also love the imported Dover Sole which comes crispy pan seared, white grape herb lemon sauce with almonds, grilled asparagus, & Shitake Risotto. Mitch’s has great wine list, too.

Sedona AZ: Golden Goose

I love the Hash Brown Crusted Scottish Salmon. It is a hand-cut filet of organic Scottish salmon that is hormone, and antibiotic free and sustainably sourced in clean Scandinavian waters. It comes encased in a hash brown crust and topped with a cranberry-orange relish. Delicious!

Read our companion Tier One blog by clicking here.

Since its inception, Life Insurance Strategies Group has solely focused on the individual high net worth life insurance market. We do not sell products. This allows us to offer unbiased, pragmatic advice. Visit us at www.lifeinsurancestrategiesgroup.com.

Comments